Join Us to Unveil Free Tax Prep and Salute Legislators

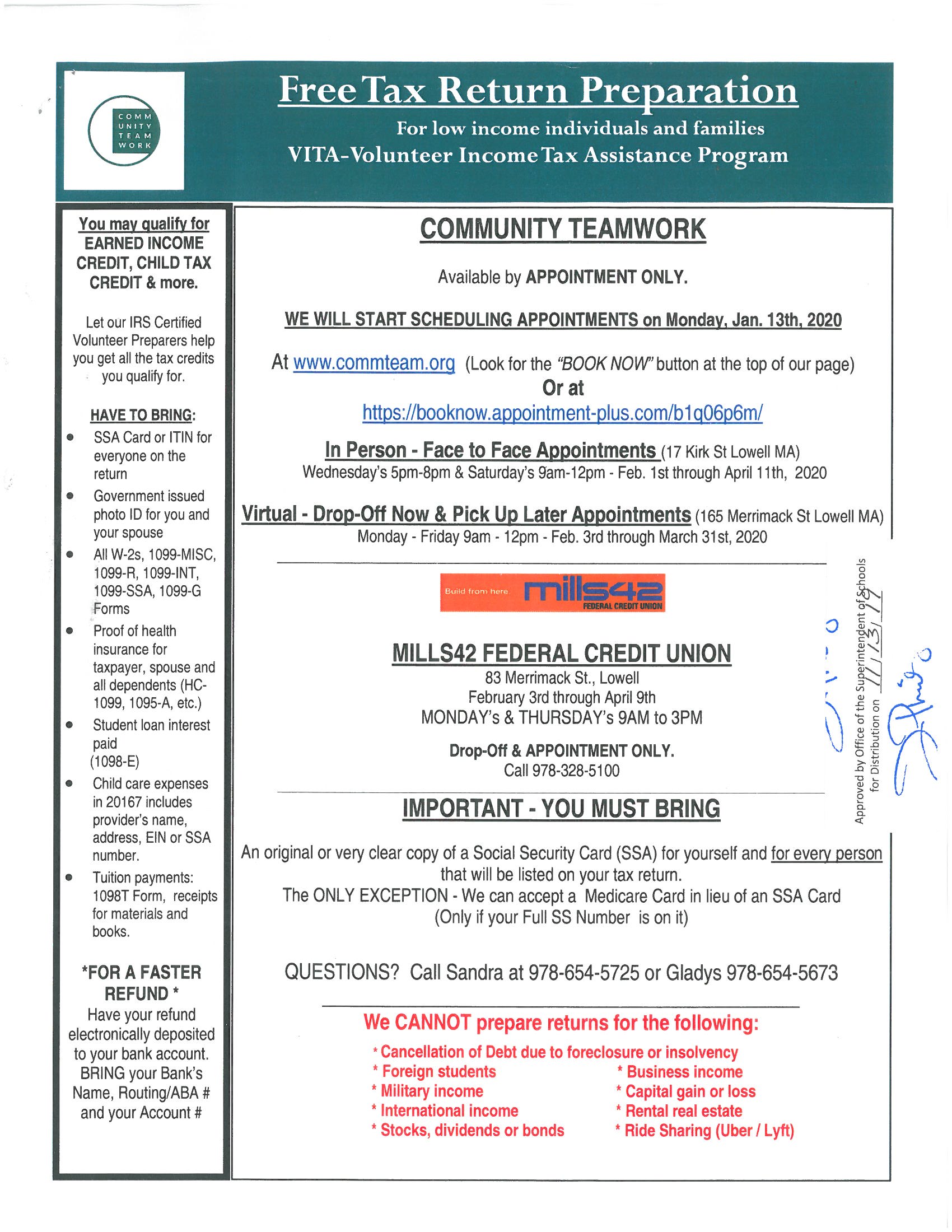

Community Teamw ork is beginning the New Year by holding a special event to recognize the important work of legislators who have successfully advocated for strong families and child education and care and to launch its EITC (Earned Income Tax Credit) and Free Tax Preparation Program through its VITA program for this tax season. Set up an appointment at Community Teamwork, 165 Merrimack Street Lowell. Contact Sandra Diaz sdiaz@commteam.org 978.654.5725 or Gladys Santiago 978.654.5673

ork is beginning the New Year by holding a special event to recognize the important work of legislators who have successfully advocated for strong families and child education and care and to launch its EITC (Earned Income Tax Credit) and Free Tax Preparation Program through its VITA program for this tax season. Set up an appointment at Community Teamwork, 165 Merrimack Street Lowell. Contact Sandra Diaz sdiaz@commteam.org 978.654.5725 or Gladys Santiago 978.654.5673

Congresswoman Niki Tsongas has praised Community Teamwork for expanding the reach of the Volunteer Income Tax Assistance (VITA) program and the Earned Income Tax Credit (EITC) program to include homeless families and individuals living in local shelters, including two operated by Community Teamwork. “The Earned Income Tax Credit and free tax preparation puts much needed money back into the hands of hard-working Americans who are struggling to make ends meet. This action benefits individuals and our local economies alike.”

“Community Teamwork provides critical supports to vulnerable families including quality child care and increased access to the Earned Income Tax Credit,” says CTI’s Executive Director Karen Frederick. “Join us in thanking legislators for their support of our efforts to increase family economic security and help us continue this work as we launch our 2014 tax preparation season.”

Congressman John Tierney, a champion of family strength, will join Community Teamwork on the 27th: “I am proud to join with Community Teamwork to highlight the important benefits of the Earned Income Tax Credit. Each year, the EITC assists over 6 million people and gives working families a much needed boost at a time when many are still struggling. As families begin to file their annual tax returns, it’s critical to have the information necessary to know if they qualify for an Earned Income Tax Credit,” said Tierney.

Community Teamwork provides these free EITC tax services and free tax preparation through its VITA (Volunteer Income Tax Assistance) Program in partnership with Mills 42 Federal Credit Union, Jeanne D’Arc Credit Union and UMass Lowell.

“The program serves senior citizens, students, individuals, families and single parents,” says CTI Executive Director Karen Frederick, explaining that, “Many use this refund as a way to stay afloat during the year, pay down debt, put money in the bank, and even make down payments for a home or to buy a car.” Last year, the program helped 537 people receive returns totaling $1.1 million. “This is a great boon to these households and to our local economy – the Earned Income Tax Credit has a great impact on poverty reduction.”